Banking on customer services: what governments can learn from the financial sector

Leadership and focus define an efficiently-run bank, and it’s no different from running a government, banking and financial executives said during a discussion on the key challenges faced by governments worldwide in achieving high level of efficiency in the delivery of services.

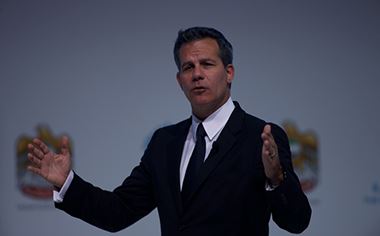

In a parallel session titled “Banking on Customer Services: What Governments Can Learn from the Financial Sector” on the second day of the three-day Government Summit, Ala’a Eraiqat, CEO of UAE’s Abu Dhabi Commercial Bank, and Gary Flood, President of Global Products and Solutions for MasterCard Worldwide, said that governments can be run as efficiently as a bank – and technology can serve as a platform to accomplish its purpose.

The session was moderated by Nadine Hani Presenter, Al Arabiya, and the two executives shared their experience and insights in improving and delivering an efficient customer experience, thus addressing one of the key challenges for governments worldwide.

Flood recalled that MasterCard started as a not-for-profit organisation before going through a series of transitions to prepare itself for the position it is in today.

“I don’t see why governments can’t continue the transition it already started to make,” Flood said, noting that for banks as well as for governments, it is important to understand the needs of their stakeholder and take an approach that is centred on those needs.

Ala’a believes that governments can deliver services as efficiently as the financial sector. “We have a live example around us,” he said, noting the way the country’s leadership has been able to focus on the needs of the UAE citizens.

“Banks, some would argue, may not be the best example of customer service or customer experience, particularly post the global crisis in the past few years,” he said. “However I think governments, especially in the UAE, have been able to raise the bar, give banks and other corporates a run for their money… and so we’re witnessing a rapid growth.” He added that the UAE is privileged to have the vigilance and the leadership that push forward “service delivery” models.

The next level within government service, he said, is how to deliver the service to individuals through face-to-face interaction or through other channels.

Based on his bank’s experience, undertaking a survey enables the institution to assess customer experience. “In everything we do, we have to ask what’s in it for our clients,” the ADCB chief executive said.

He also pointed out that there is direct correlation between customer satisfaction and profitability. Such satisfaction is also linked with trust, a driving force behind customers’ decision to leave their money with the bank without seeking high returns. For instance, at the end of 2013, 40% of ADCB’s deposits were in lower-paying current and savings accounts, well above that of their competitors.

“The bank that is able to build trustworthiness is the bank that will really do better in the long run,” he said.

In the case of MasterCard, driving a culture that adheres to customer-centric approach means driving it to the bottom of the organisation.

MasterCard has 9,500 employees worldwide, and Flood noted that the makeup and motivation is the same, whether people work for the government or a bank.

Being fair and consistent is also key in managing a financial institution well, he added.